March 17, 2023

A Wild Week, What’s Next?

Tim Urbanowicz, CFA

Head of Research & Investment Strategy

Innovator Capital Management

It’s been a wild week and a half. The liquidity driven collapse of Silicon Valley Bank marked the second largest bank collapse of all time, right behind Washington Mutual. Signature Bank fell shortly after taking the title for the third largest collapse, and finally, Credit Suisse ran into issues of its own, after its largest shareholder ruled out adding additional capital.

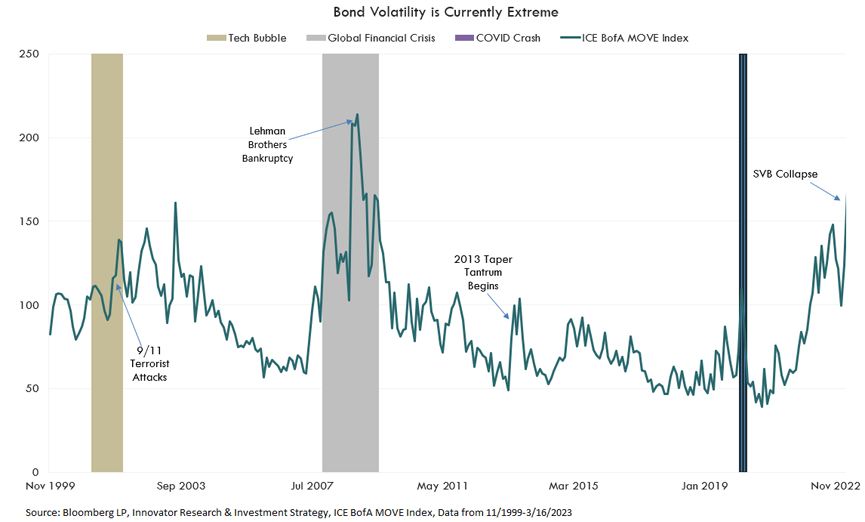

What has also been remarkable to me, has been the volatility in rates across the yield curve. The ICE BofA MOVE Index, which measures implied volatility in the treasury market, hit its highest level since the financial crisis this week.

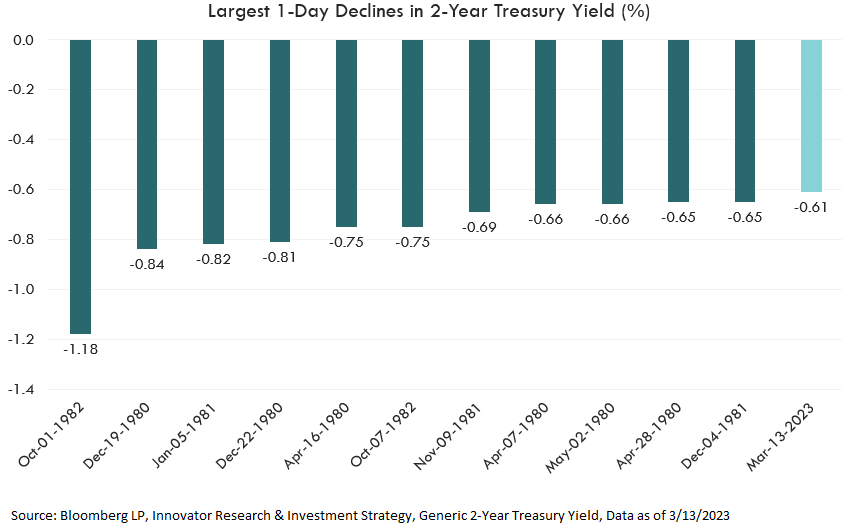

Moves on the shorter end of the curve were particularly violent. On Monday alone, the 2-year treasury fell 0.61%! That is the 12th largest one-day decline in history; even throughout the entire Global Financial Crisis, we didn’t witness a decline this large. In fact, the last time we saw a one-day move of that nature was in December of 1981, when unemployment was near 8%, inflation was firmly on its way down, and the Fed was about to cut the discount rate by 2% later in the month.

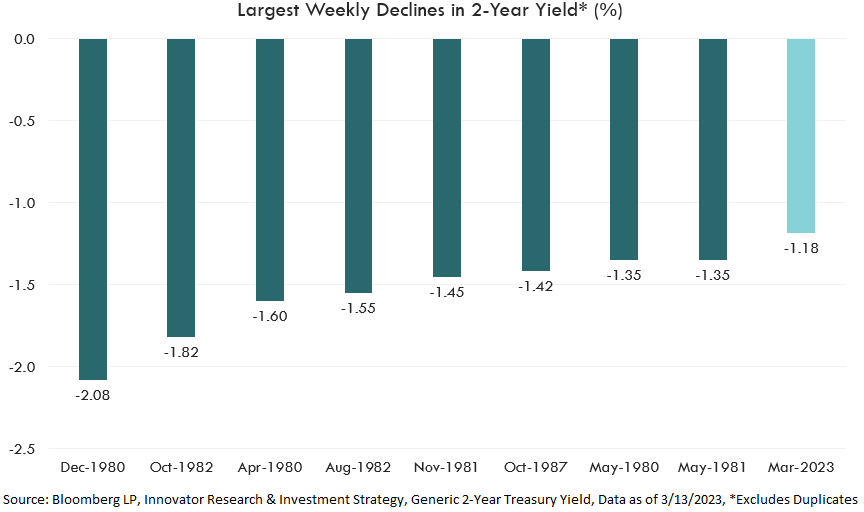

Looking at the week as a whole (Wednesday to Wednesday), the drop in the two-year equated to 1.18%. That ranks 9th all time, for weekly moves*- a remarkable one to say the least.

But were these moves rationale? To me, they feel like a bit of an overreaction that will require some repricing. Not that these events are insignificant, but have conditions really deteriorated that meaningfully to justify such a move? Maybe soon, but not yet.

What will the Fed do now?

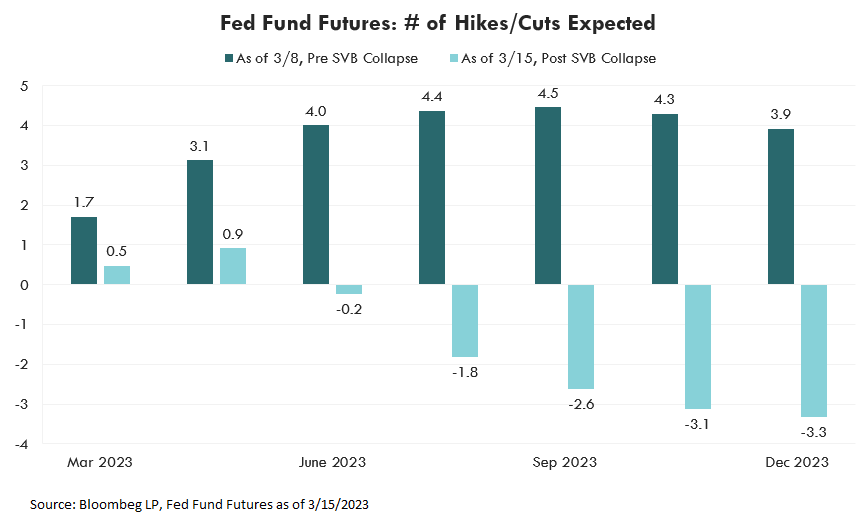

Is the Fed put back already? Was this all that needed to break? Many investors seem to think so. As of Wednesday, March 8th, Fed fund futures implied a 70% chance of a 0.50% hike next week, a terminal rate of 5.75% and no cuts in 2023. Fast forward to this week, as of Wednesday, March 15th, the odds of a 0.25% hike stood at 47%, the terminal rate was expected to come in at 4.75%, and four 0.25% cuts were priced in, by the December meeting. In the words of the great Ron Burgundy, “that escalated quickly”!

There’s only one problem with this view. Inflation is sticky. This week’s CPI print reinforced that. Undoubtably, recent events have put the Fed in a much tougher spot, but ultimately, I believe they will try and toe the line between providing support and stability for the financial sector and keeping the pressure up on other parts of the economy. Any hint of a pivot too soon could unnecessarily loosen financial conditions and create more issues down the road.

Did something break? Yes, but ultimately, they need to break or at least dent the labor market. That has been the solution historically, and I wouldn’t expect anything different this time around. We are not there yet.

When the Pivot Happens

The pivot should happen eventually, but will it be anytime soon? I’d guess that’s unlikely; there is far too much at stake for the Fed to take their foot off the gas at this point. When it does, there is going be good reason for it, and that reason is likely going to be unfavorable for risk assets (see why in our What to Watch from mid-August). As such, we continue to favor keeping a tight handle on risk in the portfolio through the use of buffered or hedged equities.

*Excludes overlapping data points to avoid double counting

The terminal rate is the ultimate interest rate level that the Federal Reserve sets as its target for a cycle of rate hikes or cuts.

Federal funds futures are liquid monthly futures contracts that investors use to bet on or hedge against short-term interest rate fluctuations.