November 23, 2022

What’s Up with Earnings?

Third quarter earnings season is wrapping up, with over 95% of S&P 500 companies reporting. All year long, earnings have taken a back seat as investors have been laser focused on inflation, Fed action, and bond yields. While macro concerns don’t appear to be fading into 2023, we believe earnings will likely to carry more weight in the new year. In this week’s commentary, we outline a few highlights from the most recent reporting season and the takeaways for 2023.

Growth is Positive but Slowing

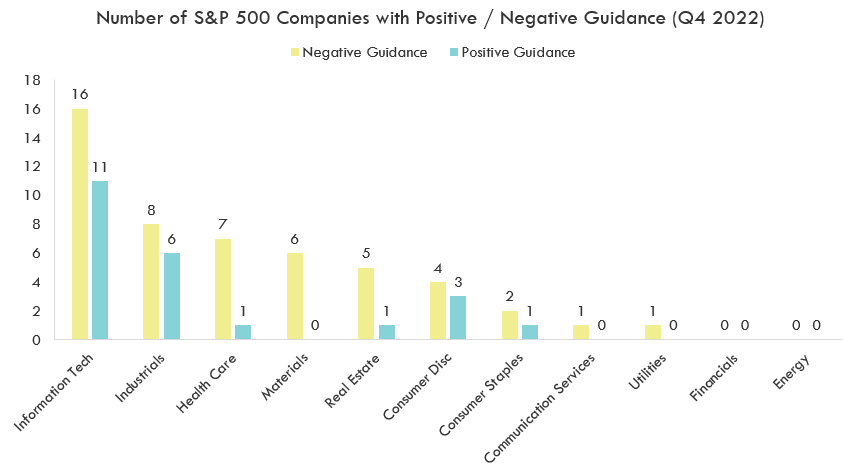

Earnings growth remained positive in the third quarter with the S&P 500 recording bottom line growth of 3% and 68% of constituents surprising to the upside. These gains will likely mark the eighth consecutive quarter of positive earnings growth, albeit the slowest reading since 2020. While results overall were strong, forward guidance was less clear, and the limited guidance issued was 70% negative.

Source: Factset, data as of 11/10/2022

Margins Finally Feel the Pressure

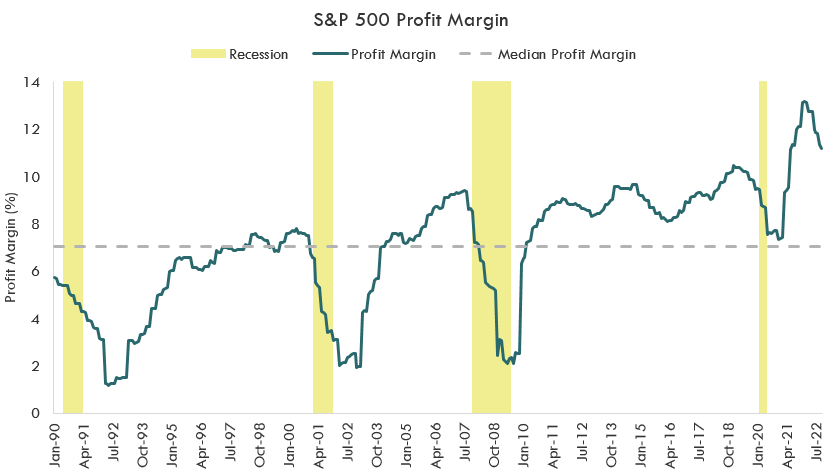

Margin growth has been a key driver of earnings growth in recent years, rising to an all-time high in Q4 2021. Up to this point, companies have been fairly effective passing on higher prices to consumers, however, Q3 results highlighted how this narrative is shifting. The S&P 500 net profit margin fell below 12% in Q3, with margins 1% lower than a year ago. While the overall level remains significantly above the long-term historical median, it has become clear that higher input costs are starting to have an impact and pricing power is limited. We anticipate this trend to continue in the new year as macro pressures begin to weigh on consumers and force them to be more cost conscious.

Source: Bloomberg LP, data from 1/1/1990 - 10/31/2022

Estimates Down, But Still Overly Optimistic

In July, we outlined why we believed earnings estimates were overly optimistic and were likely to fall into year end. While estimates are down 7% since the beginning of August, we still believe they have further to go as the market reconciles with the growth outlook. Higher borrowing costs driven by the spike in bond yields, and weaker consumer demand driven by recent Fed action, will likely slow consumer demand. As we discussed in our recent commentary, Slow to Start, Slow to Stop, Fed hikes do not have an immediate impact on the economy, and thus have a lagged impact on corporate earnings. Looking at all tightening cycles since the 1970’s, consumer spending has taken an average of 9 months to peak, and 35 months to bottom after a rate hike cycle begins. Corporate earnings have taken a bit longer, peaking on average 27 months post first Fed hike. We believe this time will be no different. The question is, how big of a blow will recent hikes deal? We believe it will be in excess of current estimates.

The Bottom Line

Look for corporate earnings to share the spotlight with the macroeconomic backdrop in 2023. Should growth continue to slow, margins continue to compress, and estimates continue to see downward revisions, we believe investors will need to prepare for continued volatility in the new year.