January 30, 2023

Should Investors Believe the Fed?

Tom O'Shea, CFA

Director of Investment Strategy

Innovator Capital Management

Investors vs. the Fed

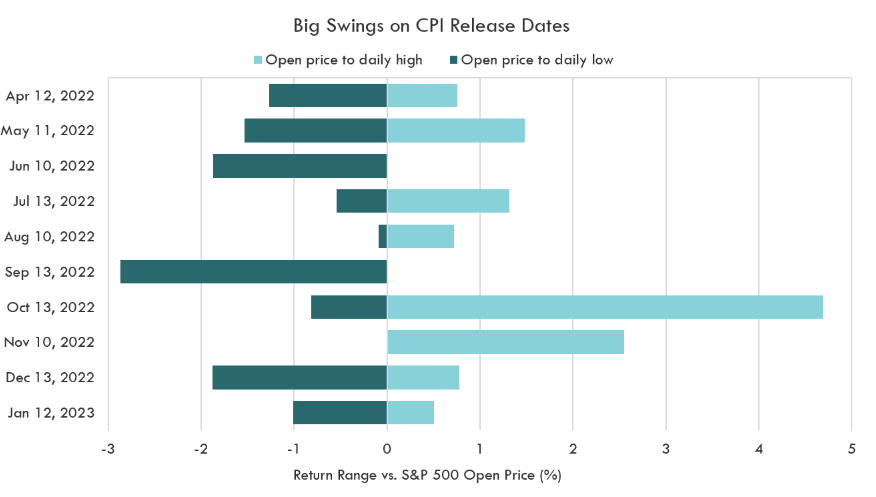

Investors with opposing expectations for Federal Reserve tightening decisions have caused a push and pull in the financial markets. The Headline Consumer Price Index (CPI) peaked last year at 9.1%, and has been trending lower since. Each surprise reading that posts lower than survey expectations, seemingly convinces investors that the downward trend in inflation is enough for the Federal Reserve to cut rates in the back half of 2023. Fed officials have then worked to squash these hopes for fear of financial conditions easing and potential resurgence in inflation. The chart below demonstrates the large one-day swings from this excitement for a pivot, and investor disappointment that followed as Fed officials convince them a pivot is far away.

Source: Bloomberg L.P., Bureau of Labor Statistics, S&P, Innovator Research & Investment Strategy. Past performance does not guarantee future results.

The Futures Market Isn't Much of a Crystal Ball

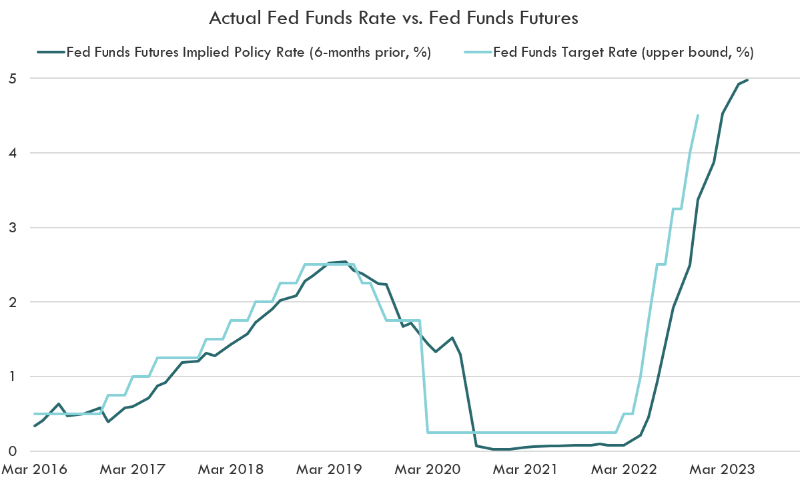

Is the Fed just talking tough or will they stick to their word and maintain restrictive policy? Equity investors in the S&P 500 may be pricing in a pivot with the index up 4.7% year-to-date. The bond market doesn’t believe the “tough talk” as rates have fallen across the curve. Similarly, Fed Funds futures are pricing in about two, 0.25% rate cuts in the back half of the year. But how accurate have Fed Funds futures been at predicting the actual Fed Funds rate?

Source: Bloomberg L.P., Innovator Research & Investment Strategy. Fed Funds Target Rate data from 3/31/2016 - 12/31/2022. Futures data from 9/30/2015 - 12/31/2022.

The Fed Funds futures data in the above chart demonstrates the difficulty in predicting the true Fed Funds rate as short as 6 months out. The futures market tends to underestimate the true rate during tightening cycles and overestimate rates during the cutting cycle. With inflation still above the Fed’s 2% target, the futures market may follow history and underestimate the true policy rate as the Fed continues tightening in 2023.

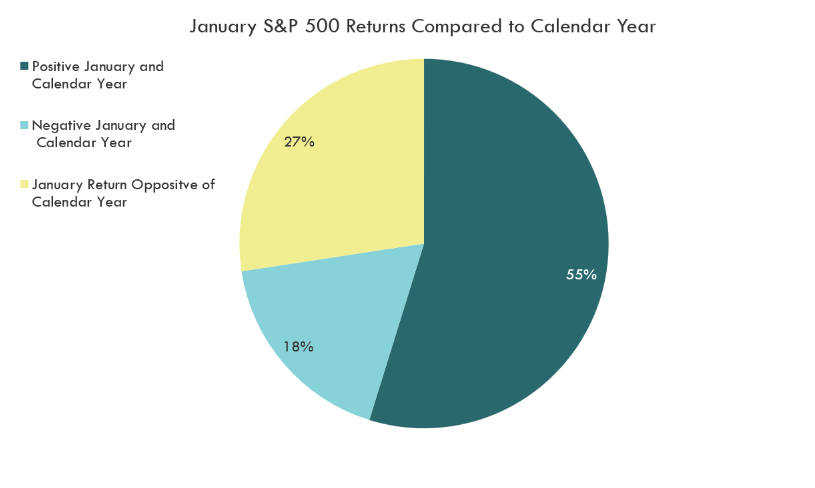

January Returns and Calendar Year Performance

We believe anticipating future Fed policy moves is polarizing investors. Higher rates mean higher borrowing costs and a headwind to earnings. Investors expecting higher rates may be driven to less risky assets, and those expecting lower future rates have flooded into the equity markets. As a result, the S&P 500 is up nearly 5% in January. Do we expect this momentum to continue? History showed that U.S. equities have finished the same direction for the calendar year as they did in January, 73% of the time. Although this figure is high, too much uncertainty exists on the inflation and monetary policy fronts to extrapolate performance through the entire year.

Source: Bloomberg L.P., S&P, Innovator Research & Investment Strategy. Monthly data from 12/31/1928 -12/31/2022. Past performance does not guarantee future results

Bottom Line

The contrasting expectations from Fed officials and markets on future policy rates will likely increase overall volatility. We believe the Fed will not cut rates in 2023 because an early pivot may lead to resurging inflation, followed by a prolonged period of restrictive monetary policy. Buffer strategies may work well in either scenario; seeking to provide a known downside buffer or providing upside participation to a predetermined cap.

The Consumer Price Index, or CPI, measures the overall change in consumer prices based on a representative basket of goods and services over time.

The Buffer ETFs have characteristics unlike many other traditional investment products and may not be suitable for all investors. For more information regarding whether an investment in the Fund is right for you, please see "Investor Suitability" in the prospectus.