February 13, 2023

Getting Ahead of Ourselves

My son turned 4 in August and I have been loving it. I consider it a sweet spot - he’s able to do most things on his own, but is still overjoyed by the small things; all within his innocent 4-year-old mindset. One of my favorite things we enjoy doing together at this new stage is travel. 2 years ago, it was very difficult to keep him entertained and in his seat on a flight, but not at 4. Now it’s a blast!

Most recently, he joined me on a work trip to New York so he could visit his grandparents. About 2 weeks prior, I let him know about it, and as you can imagine, he was excited. He was so excited in fact, the morning after breaking the news, he comes into my room around 5am, suitcase packed, and announces that he is “ready to go to Gram and Grandpas house”! This was a quick lesson for my wife and I, that we either needed to do a better job explaining how long two weeks was, or just wait to tell him until it gets a little closer next time!

In a similar vein, I believe many investors have been getting ahead of themselves recently, when in reality, now is the time they should be exhibiting patience. In this month’s newsletter, I outline three areas this early exuberance is showing up, and discuss how investors can effectively practice patience in the current environment.

Recession in 2023?

Soft landing or hard landing? Recession or no recession? In my mind, there is no question more important.

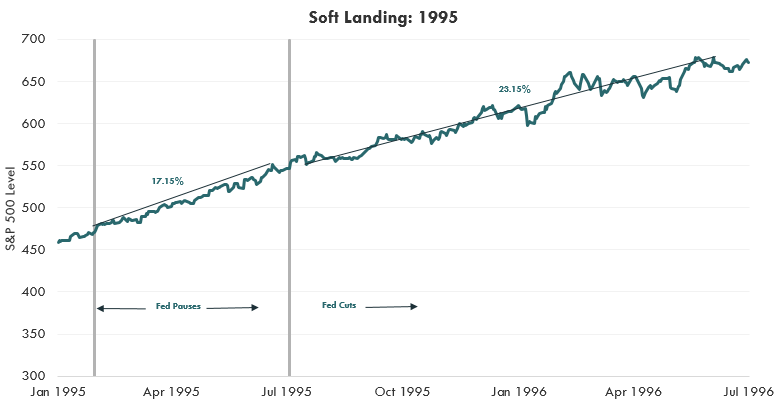

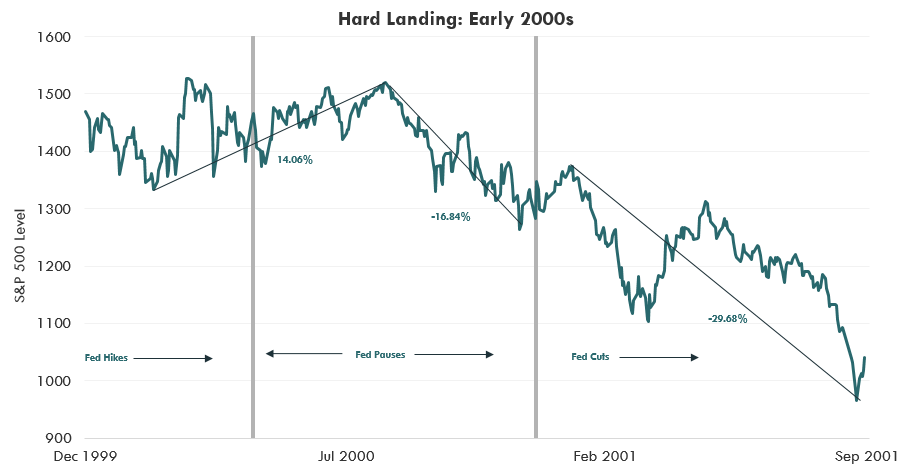

Markets are always giddy and rally around the potential for a Fed pause or Fed pivot, but the reality is, that performance is always short lived. After the initial run up, there is a divergence in returns based on the damage the cycle dealt, and the answer to that crucial question. The examples below from the mid-1990s and the early 2000s highlight this dynamic.

Source: Bloomberg LP, data from 1/3/1995 – 7/3/1996

Source: Bloomberg LP, data from 12/31/1999 – 10/1/2001

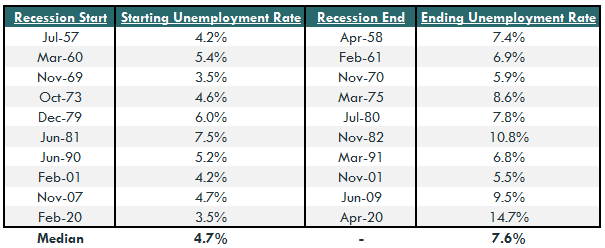

But is this a conversation for 2023? 60-70% of economists seem to think so. While this is certainly a possibility and a risk that shouldn’t be ignored, I’m of the mindset that 2023 could be premature. The labor market is still red hot and unemployment is as low as it’s been since 1969. And yes, employment isn’t the only factor, but it is a big one and it drives many other pockets of the economy. Entering a recession with unemployment below 3.5% would be a record. As shown in the table below, the median unemployment level at recession onset has been 4.7% and lowest level was 3.5% in 1969. A big spike isn’t going to happen overnight, especially in services where employers have invested energy and resources to fill roles after the pandemic.

Source: Bloomberg LP, Unemployment Rate, National Bureau of Economic Research. Data from 7/31/1957 – 4/30/2020

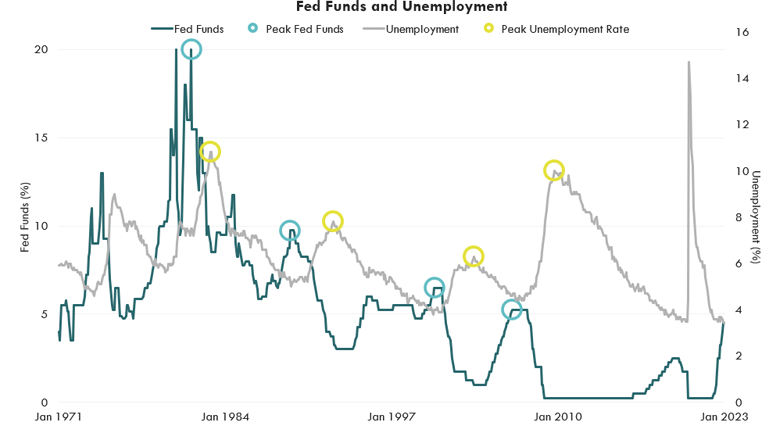

I do believe the continued strength has widened the narrow path to a soft landing. Albeit good news, let’s not get too far ahead of ourselves either. The labor market always takes time to digest changes in monetary policy, and unemployment typically doesn’t begin to rise until 6-7 months after the Fed hike cycle is over. The current strength is likely kicking the recession debate down the road, and I believe investors will need patience before getting more insights into the soft vs. hard landing debate.

Source: Bloomberg LP, Federal Funds Rate, Unemployment Rate, 1/31/1971 – 1/31/2023

Rate Cuts in 2023?

One thing was clear to me after the last Fed meeting: the market doesn’t believe the Fed. Despite Powell vowing the Fed is not done and the fight is not over, the market reacted as if he had just announced a return to zero interest rate policy! Equities and bonds rallied, and the futures market started to price an even greater probability of two cuts in the back half of the year.

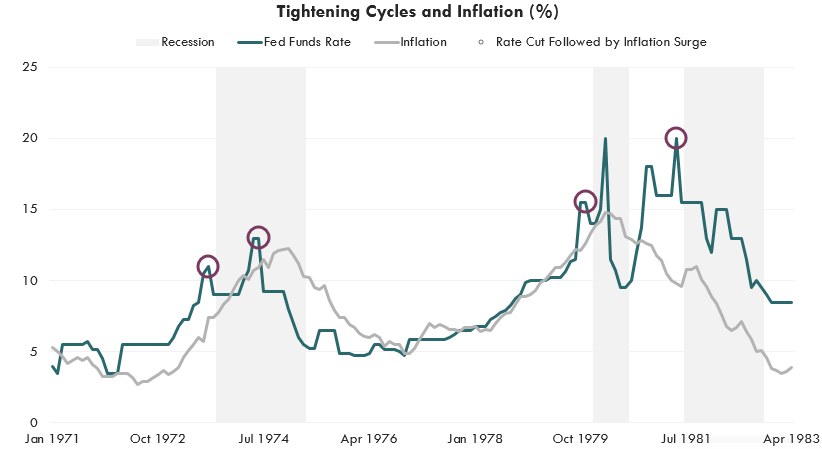

I struggle to understand the view that rate cuts in 2023 are imminent - it’s far too early. In my opinion, it’s also a simple risk/reward tradeoff for the Fed, that heavily favors risk. The risk of a resurgence in inflation far outweighs the risks of an economic downturn. And with the labor market as tight as it is, why risk it? I understand this isn’t the 1970’s; the backdrop is different, but I have to imagine Powell and team recognize the pattern of inflation that played out in that decade plus. As shown below, there were four separate instances (purple circles) where rates were cut, financial conditions eased, and the inflation issue was exacerbated. The Fed is not going to want to make a similar mistake.

Source: Bloomberg LP, Federal Funds Rate, CPI yoy (%), 1/31/1971 – 4/30/1983

Inflation may very well be on its way down, but contrary to current market pricing, the battle isn’t over and a premature pivot could be costly. If and when the market comes to this realization, bonds and equities may likely require some repricing.

The Start of a Bull Market?

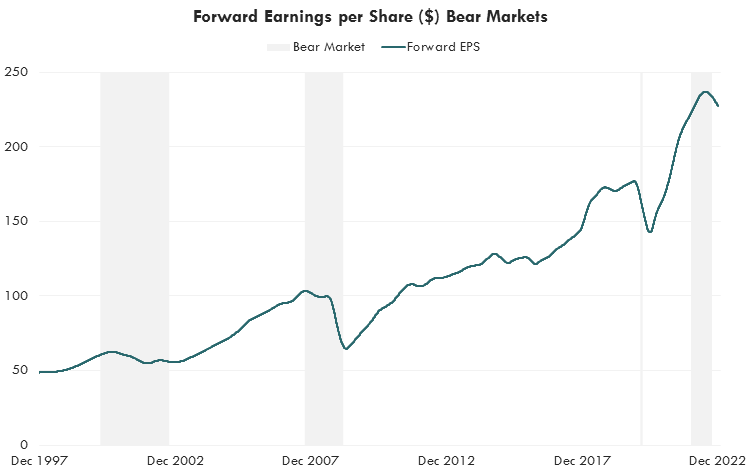

Equities have seen a strong rally since mid Q4, but is this the start of the new bull market? Maybe, but I doubt it. Historically, bear markets consistently bottom close to the time earnings bottom, and corporate earnings take time to digest higher interest rates. The chart below highlights this dynamic throughout the last 3 bear markets.

Source: Bloomberg LP, 12 Month Forward EPS, 9/30/1997 – 12/31/2022

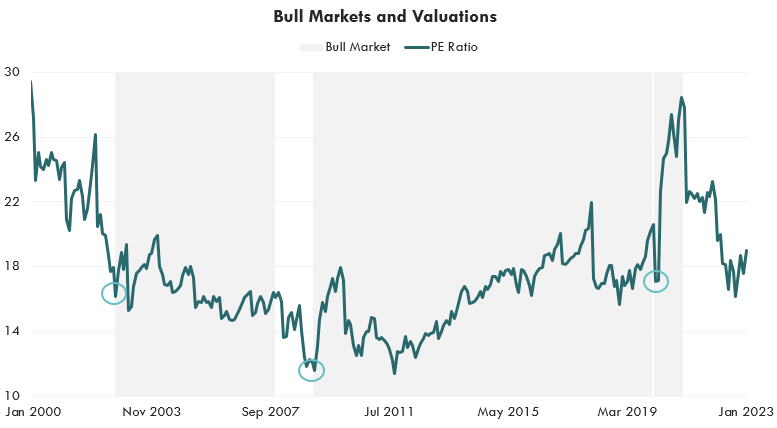

We also see bull markets have historically began when valuations reset and found a bottom. While valuations derated meaningfully last year, this would still be the highest starting point for a bull market we have ever seen.

Source: Bloomberg LP, Bull market defined as gains between bear markets, 12/31/1999 – 1/31/2023

Perhaps this time is different? Is the market looking through the earnings slowdown and ready for a resurgence? It is possible, but I doubt it. A resurgence right now would be highly inconsistent with anything we have seen before. Instead, don’t be surprised if speculative moves up and down continue until we get a better look into the soft vs. hard landing debate.

For the Portfolio

So how can we position the portfolio at this point? Below are three ideas to help navigate a potentially choppy market, where patience will be important:

#1- Cautiously Keep Clients in the Equity Market.

With all the uncertainty that lingers, I understand staying invested in equities is not easy, especially with cash yields as high as they are. But, I feel it is important. If the market is in fact looking past the near-term growth outlook, or if risks resolve quicker than anticipated, I wouldn’t want to miss out.

#2- Be Ready for Flat, Choppy, and Volatile Markets.

Patience here is a virtue. If markets are flat, choppy, and volatile, over the next year, strategies that can help generate a positive return, without requiring a sustained rally in equities, may be beneficial.

#3- Be Cautious on Adding Duration.

With rates up, it is tempting to try to lock in higher yields further out on the curve, but I would be cautious extending duration at this point. Rates still face a lot of pressure from quantitative tightening and are pricing a very aggressive stance with regards to inflation and the Fed. Short and intermediate duration fixed income may offer a compelling alternative, as well as hedged equity allocations that come with a bigger buffer. Bond laddering may also be an effective strategy.

CPI, or Consumer Price Index, measures the overall change in consumer prices based on a representative basket of goods and services over time.