March 14, 2023

Breaking the Ties

Anyone who understands nutrition knows the overwhelming majority of packaged foods should be avoided. Outside of the processing and added preservatives, most all have one thing in common…added sugar, and in many cases, lots of it. Even the so-called “healthy” brands struggle to break free. It may be “reduced”, but it’s still in there. No doubt they are quick and easy, but with this commonality, for me, clean eating typically means cutting the cord on packaged foods altogether.

Investors are facing a similar situation today; we live in a world where financial markets can’t break free from inflation and interest rates. Perhaps the most frustrating part about this dynamic has been the impact of these two factors across the entire portfolio. Clients expect volatility and risk from their equities, but it’s never good when the “income and protection” sleeve takes a beating at the same time.

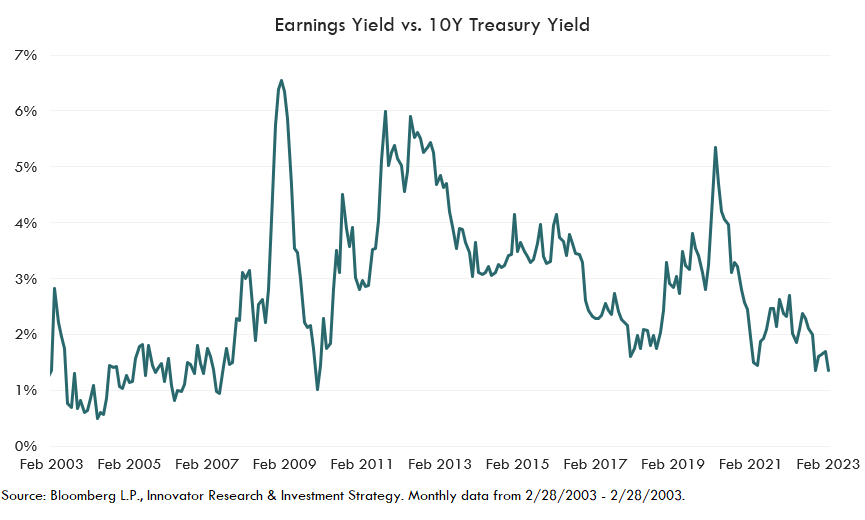

In the wake of last year’s big sell-off, however, and with yields hovering at their highest level in over a decade, is now the time to up the bond allocation? I don’t think it is. Admittedly, bonds currently score well relative to equities; the earnings yield vs. bond yield gap is at its lowest level since 2009 (chart below), and the implied equity risk premium is anemic. The problem, however, is that inflation remains a major threat and bonds are vulnerable.

Right now, it is important to focus less on attractive yield and relative value, and more on decoupling income and protection needs from inflation and interest rates. In this month’s newsletter, I outline why breaking this tie to is so important.

Inflation Reset is Typically a Marathon, not a Sprint

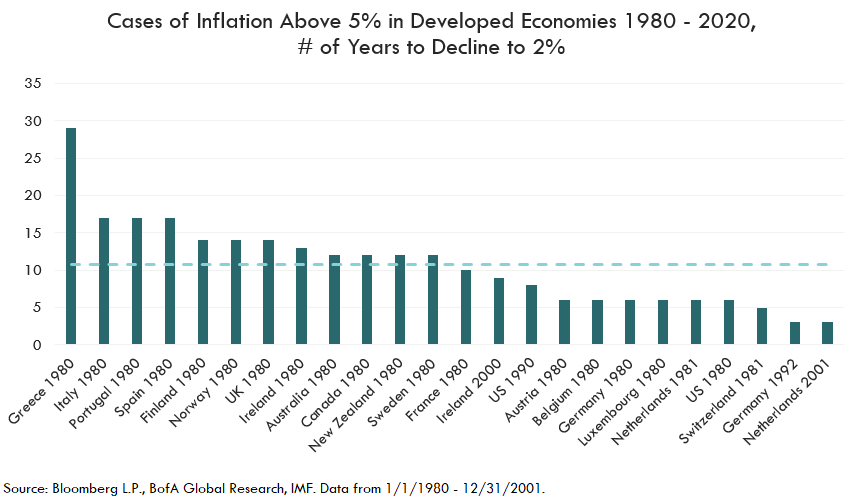

Inflation has never been transitory. We have never seen it just come down overnight, like many hoped it would after the pandemic. It has always taken time. The chart below examines all cases of inflation above 5%, across developed market economies since 1980, and the number of years it has taken to return to 2%. The average time? Between 10 and 11 years. We have also never seen a return to 2% in less than 3 years.

Will we be on the shorter end this time around? I hope so, but it’s too early to tell. We have yet to see the long-term implications of reckless fiscal spending, what the shift from globalization to deglobalization looks like, or how long the war in Ukraine will last. Bottom line, I don’t want to put portfolios at risk, in hopes of unicorn event. More persistent inflation would likely drive interest rates higher, and higher interest rates could mean more volatility for the bond allocation.

Diversification Benefits: Returning Anytime Soon?

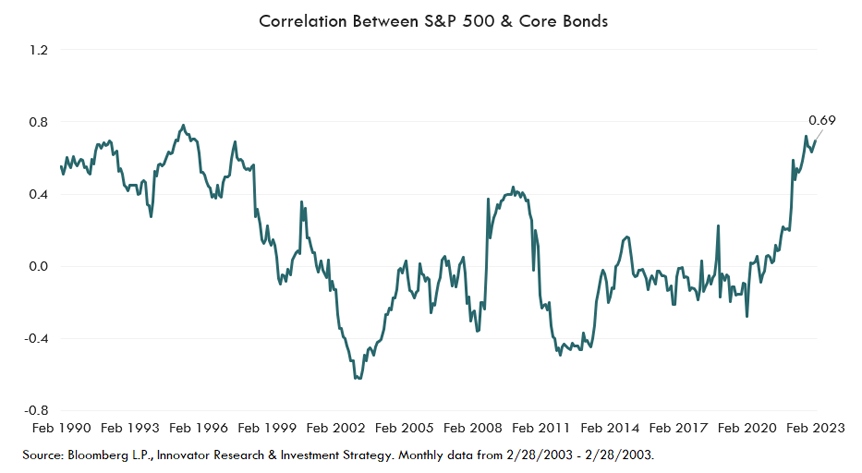

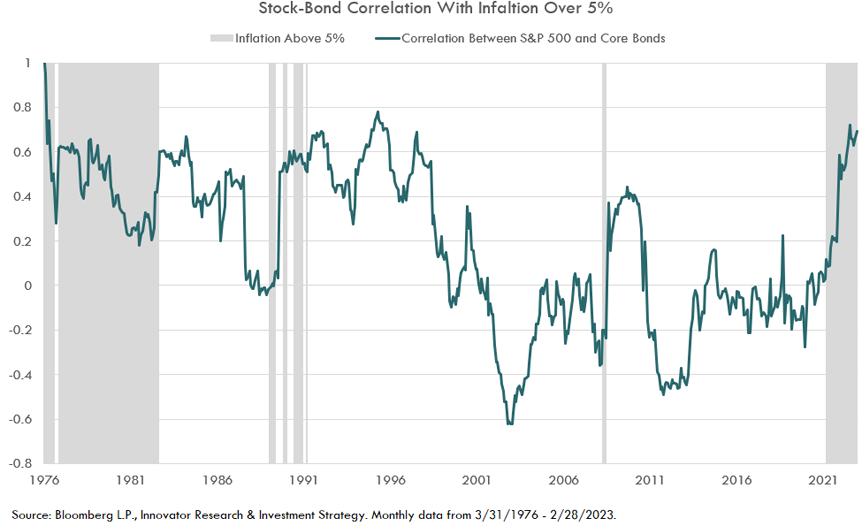

Diversification has been a key benefit of the fixed income allocation over the years. When equities sell-off, we want a portfolio’s bond allocation to hold steady. This obviously has not been the case recently. The correlation between the S&P 500 and the US Aggregate Bond Index (the Agg) remains at the highest level in nearly 30 years as inflation continues to drive both bond and equity prices lower.

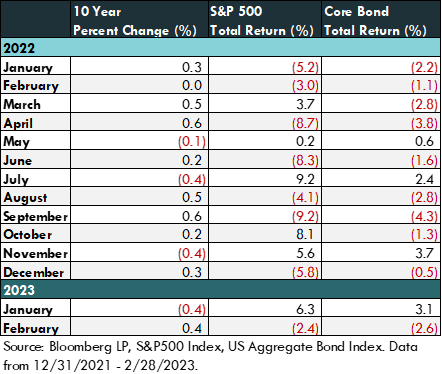

As shown in the table below, the bond yield and equity price relationship has been very consistent over the last 14 months. In fact, since the start of 2022, there have only been two calendar months where the S&P 500 and the Agg have moved in opposing directions. To say the least, the traditional diversification benefits from an asset allocation have been greatly diminished.

But are the benefits returning anytime soon? Looking at historical episodes of high inflation doesn’t give me confidence that they are. When inflation has been north of 5%, we see the median correlation between equities and bonds at 0.5%. There has only been one instance where the correlation has been negative, and that was mid-2008, right before the major equity market sell-off when inflation was falling off a cliff. Most other periods have seen correlations elevated, similar to where we see them right now.

So, when will diversification benefits return? If history is our guide, it’s probably closer to when we see a more meaningful inflation drop.

Higher Yields are Great, But they Don’t Matter Much Until the Move Higher is Finished

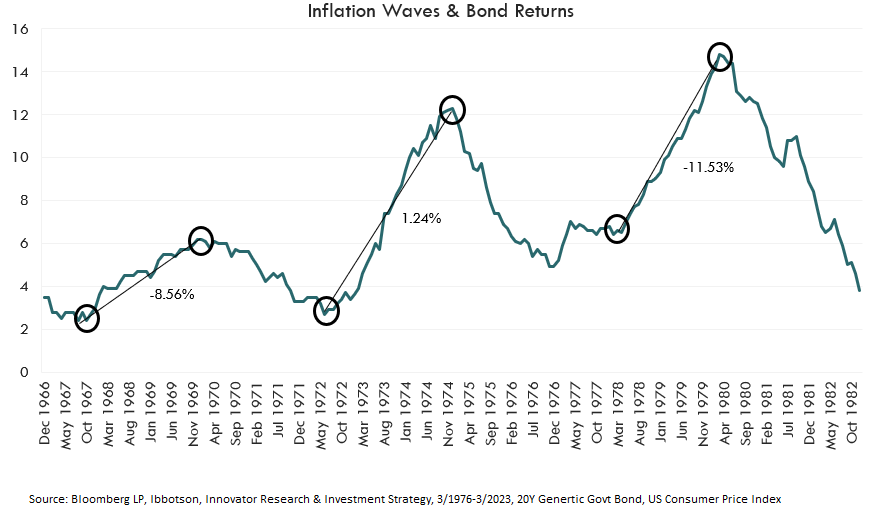

Persistently high inflation has the potential to derail financial plans built on a traditional asset allocation. The inflation epidemic in the 60’s, 70’s, and 80’s gives us a good view, not only into the waves that inflation can come in, but also how destructive it can be to the income and equity sleeve of a portfolio.

Looking at the three waves we saw in the US from the late 60’s to early 80’s, long duration bonds delivered a nominal price return of -19%, -9%, and -34% (total returns of -9%, +1%, and -12%), from each individual trough to peak.

And talk about enticing yields! In the graph above, the average 10Y treasury yield was more than 8%, and topped out just under 16% in 1981. Higher yields are great, but they can be offset by downward price moves as yields push higher.

For the Portfolio

Whether it’s income or protection, I feel breaking the tie to interest rates and inflation is so important. Below are a few ideas to help the portfolio do just that:

#1- Seek alternatives, that can help generate income, such as option premium strategies. These may be viable in the current environment. Higher equity volatility can also lead to higher premiums and thus higher levels of income. Adding a layer of risk management here would also be favorable.

#2- Continue to be cautious around extending duration. Fear of missing out on the chance to lock in decade high yields is understandable, but keeping duration short/intermediate or even laddering bond allocations may be more reliable.

#3- I know yields are attractive, but bonds may continue to be an unreliable source of downside protection, especially if higher inflation is the risk trigger. Buffered and hedged equity strategies can help dial down the overall risk profile of a portfolio, without relying on traditional fixed income.

A unicorn event is one that is unique, rare, or unlikely it will ever happen again.