April 28, 2023

A Look at Earnings: Too Pessimistic, but yet too Optimistic

Tim Urbanowicz, CFA

Head of Research & Investment Strategy

Innovator Capital Management

We are roughly a third of the way through Q1 earnings season, and thus far, results have come in better than anticipated.

Heading into the quarter, consensus estimates were calling for year-over-year growth to come in at -6.7%. If those estimates were to play out as forecasted, Q1 would mark the worst quarter of growth since Q2 2020. So what might be in store for the rest of the season and beyond?

We Believe Current Quarter Estimates are too Pessimistic…

We have been, and continue to be, of the mindset that expectations for Q1 are overly pessimistic. Actual earnings have surpassed estimates in 37 of the previous 40 quarters, and we would anticipate this trend to continue, especially given the low bar to clear in Q1.

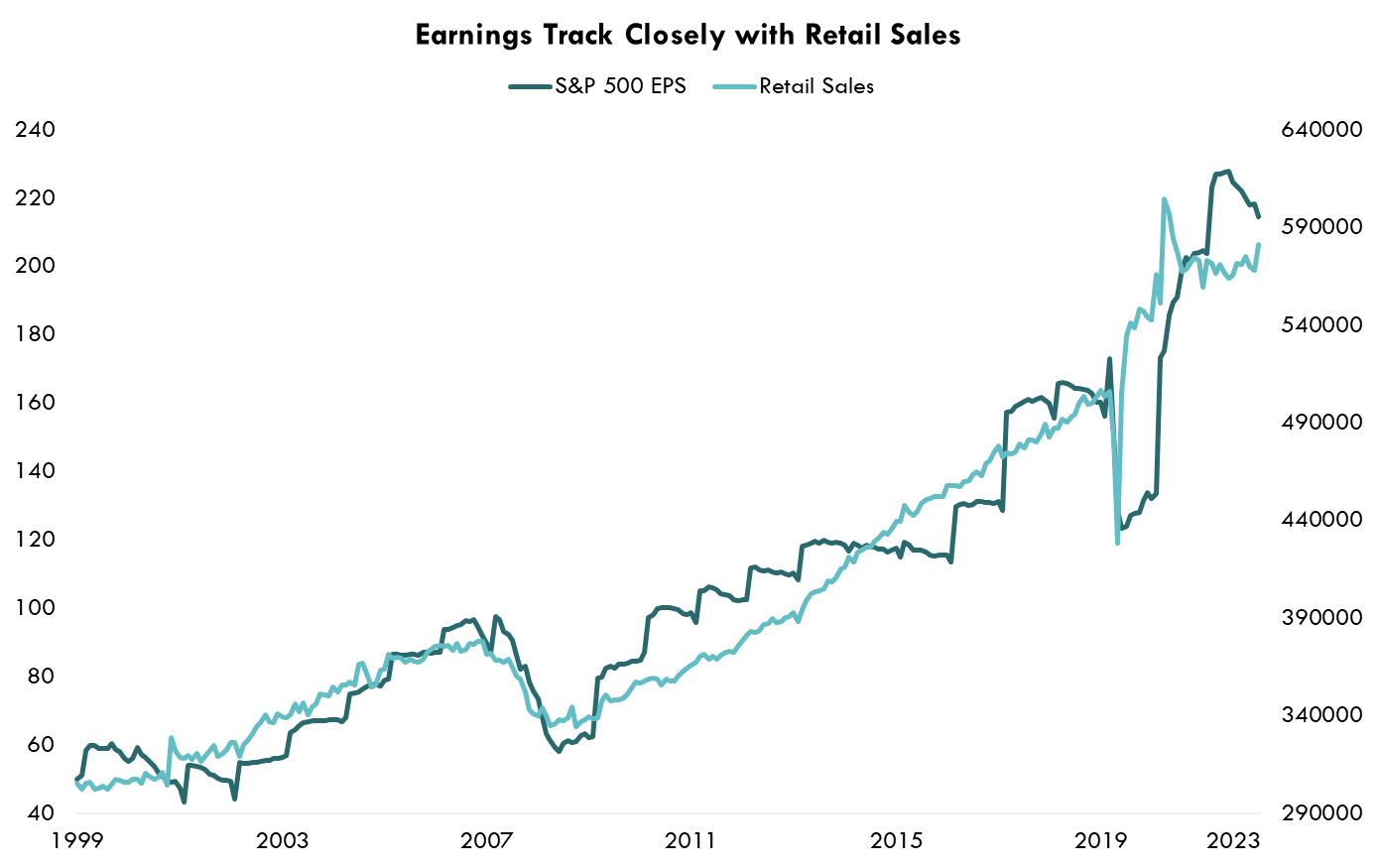

As shown in the chart below, earnings have generally moved in line with consumption (retail sales, consumer spending, etc.), and up to this point, we have not seen a major decline. Consumers have remained fairly resilient and in our opinion, haven’t pulled back enough to justify the bleak Q1 estimates. While this doesn’t necessarily mean a positive growth rate for the quarter, it does bode well for companies clearing the low bar.

Source: Bloomberg LP 12/31/1999-1/31/2023, Retail Sales, S&P 500 Earnings Per Share

...But Estimates for the Back Half May be Overly Optimistic

While we believe Q1 estimates may prove overly pessimistic, estimates for the back half of the year may be overly aggressive, given the growth outlook. Current consensus estimates are calling for a rebound in the back half, with positive growth of +1.6% in Q3, and +8.5% in Q4, for a full calendar year growth rate of ~+1%. In our view, it will be tough to justify these estimates if economic growth is falling.

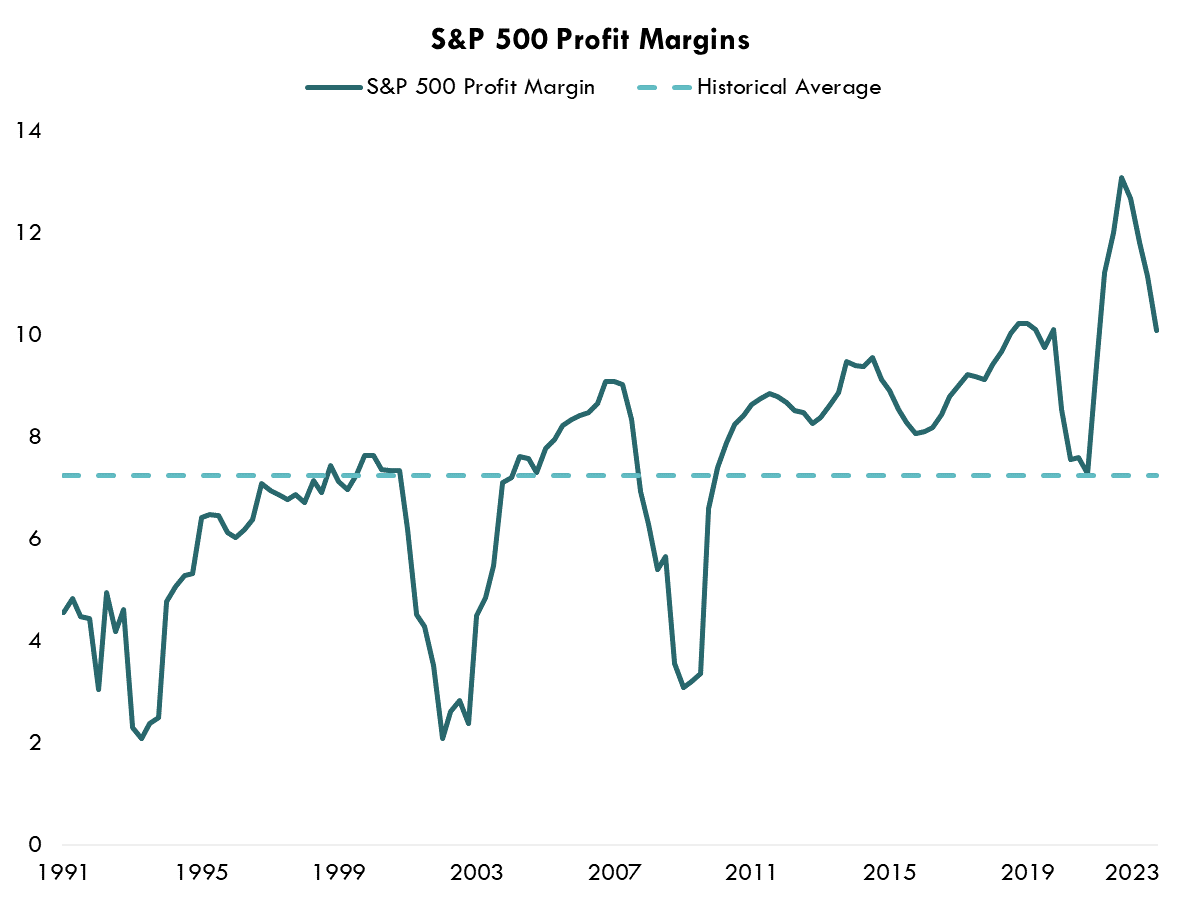

Sales will likely face major challenges from the mediocre growth outlook, and margins may continue to face pressures of their own. As shown in the chart below, margins spiked aggressively throughout the pandemic, peaked in June of 2022, and have been coming down ever since. Despite the drop, they remain well above the historical average. We would expect a continued reversion to the mean as corporate pricing power softens, and higher interest rates and higher labor costs weigh in. All that to say, there is a much higher bar to clear in the back half of 2023 and beyond.

Source: Bloomberg LP, S&P 500 Index Profit Margin 6/28/1991 – 3/31/2023

If History is our Guide…. Don’t Expect a Bottom in Earnings Anytime Soon

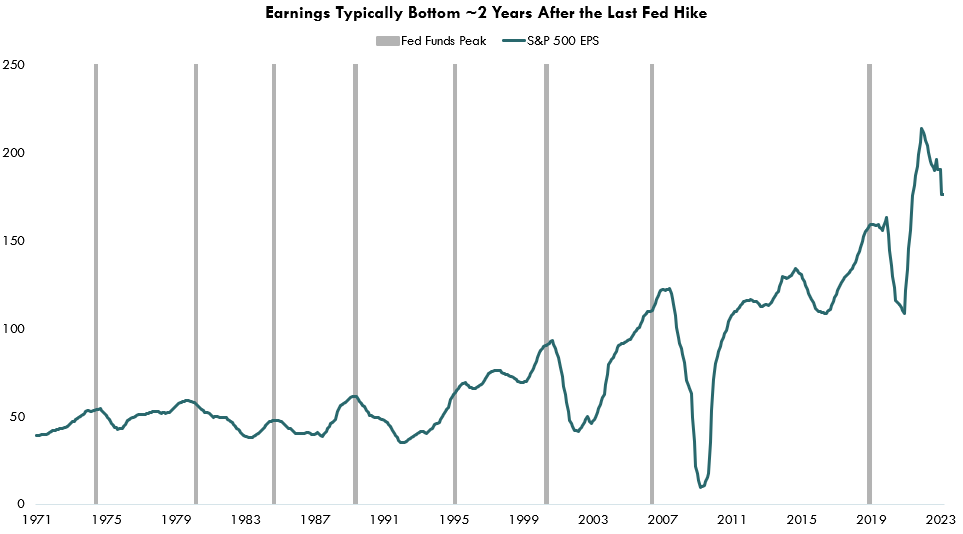

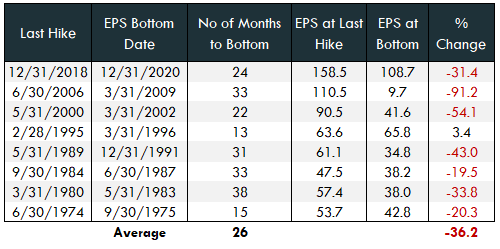

As we (hopefully) near the end of the interest rate hike cycle, it’s important to look at how earnings have behaved after the final hike. As shown in the chart below, S&P 500 earnings per share have bottomed anywhere from 15 months to 38 months after the last Fed hike in the cycle, and never before. And, in 7 of 8 instances, earnings actually continued to move higher, for an average of 3.8 months after the final hike.

Source: Bloomberg LP, Innovator Research & Investment Strategy, Federal Funds Rate, S&P 500 Index, 1/31/1971-3/31/2023

The average drop from the time the Fed pauses to the bottom has been 36%. Needless to say, if history is our guide, we shouldn’t expect earnings to bottom anytime soon.

Source: Bloomberg LP, Innovator Research & Investment Strategy, Federal Funds Rate, S&P 500 Index 6/30/1974-12/31/2018.

Past performance in not indicative of future results.

The Bottom Line

Corporations may have a low bar to clear in Q1, but we feel estimates for the back half of the year are too optimistic. For portfolios, we continue to emphasize the importance of staying risk aware, versus risk on, and not risk off.

It is not possible to invest in an index.

S&P Earnings Per Share is the average earnings per share of all S&P 500 companies. Earnings per share is a company's net profit divided by the number of common shares it has outstanding.